Following a few weeks of turbulence in the Government, accompanied by growing economic uncertainty for UK households at a time when the cost of living is having an expanded impact on financial decisions, Rishi Sunak was named prime minister on 24 October.

His appointment has brought stability to the financial markets; he was formerly a hedge fund manager and was chancellor under Mr. Johnson. He was careful and more prudent than his predecessor Liz Truss.

The top priority for Rishi and his Government is to get the UK’s finances to help reduce the cost-of-living crisis for households and businesses.

Andrew Dyson CEO of Build Warranty attended parliament on 1st November for the launch of the NHQB Consumer Code and met with Housing Minster Rt Hon Lucy Frazer KC MP,where she expressed that increasing homeownership is a key part of the government’s agenda.

The health of the housing markets is inseparably linked to the economy’s health, particularly the mortgage market, with interest rates of almost 6%, after halting new fixed-rate home loans last week following turbulence in the UK government bond market.

The cost of borrowing for both Government and business has recently fallen. It is forecasted to fall further in the weeks ahead as markets react to the message about balancing the books.

The Impact of the September mini-budget

Last month’s tax-slashing “mini” budget rattled the markets, spiralling the pound to fall to a 37-year low against the dollar. Lenders pulled thousands of mortgage products and recalculated their offerings. Rishi Sunak will need to tread carefully as he unwinds from the brief reign of financial chaos we lived through under the previous Government.

We have already seen the new chancellor, Jeremy Hunt, reversing most of the announcements made by Kwarteng in his mini budget but has decided to keep the cuts of stamp duty – which may incentive house buyers.

The Bank of England had to step in, to calm markets by temporarily purchasing long-dated UK government bonds to restore orderly market conditions.

And this week, we saw the announcement of a new prime minister, Rishi Sunak; economic markets responded in favour of his appointment, bringing stability and unity to the needs — including the property market.

Will house price growth slow in 2023?

The average price of a UK home has nearly trebled since the turn of the century. According to Nationwide, prices increased more than 60% over the last ten years.

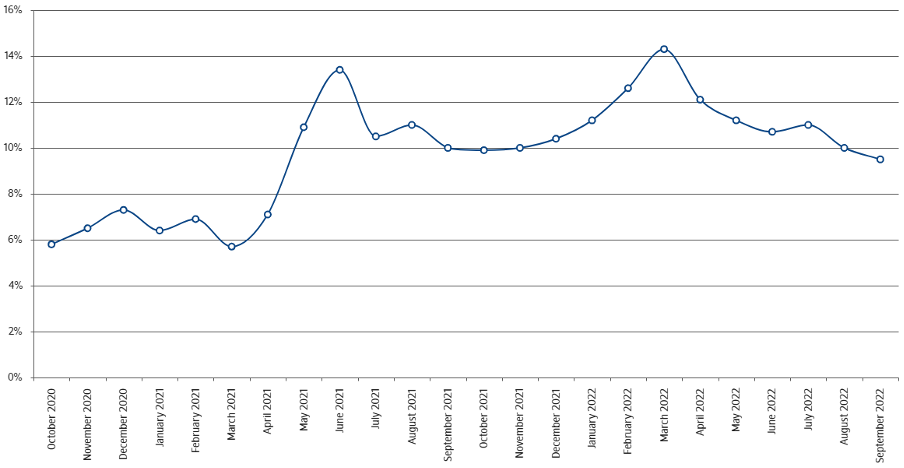

The latest figures from Nationwide show an annual growth sitting around 9.5% but monthly growth falling from 0.7% to 0.0%. Meaning the average house price in the UK is now £272,259. That’s still more than a fifth higher than the pandemic’s start.

On the surface, one of the key drivers has been the lack of supply and more demand: a housing shortage and the need for housing by home buyers.

While there has been growing speculation that the housing market could crash in 2022, in September, the annual house price growth slowed to single digits for the first time since October last year, although, at 9.5%, the pace of increase remained strong.